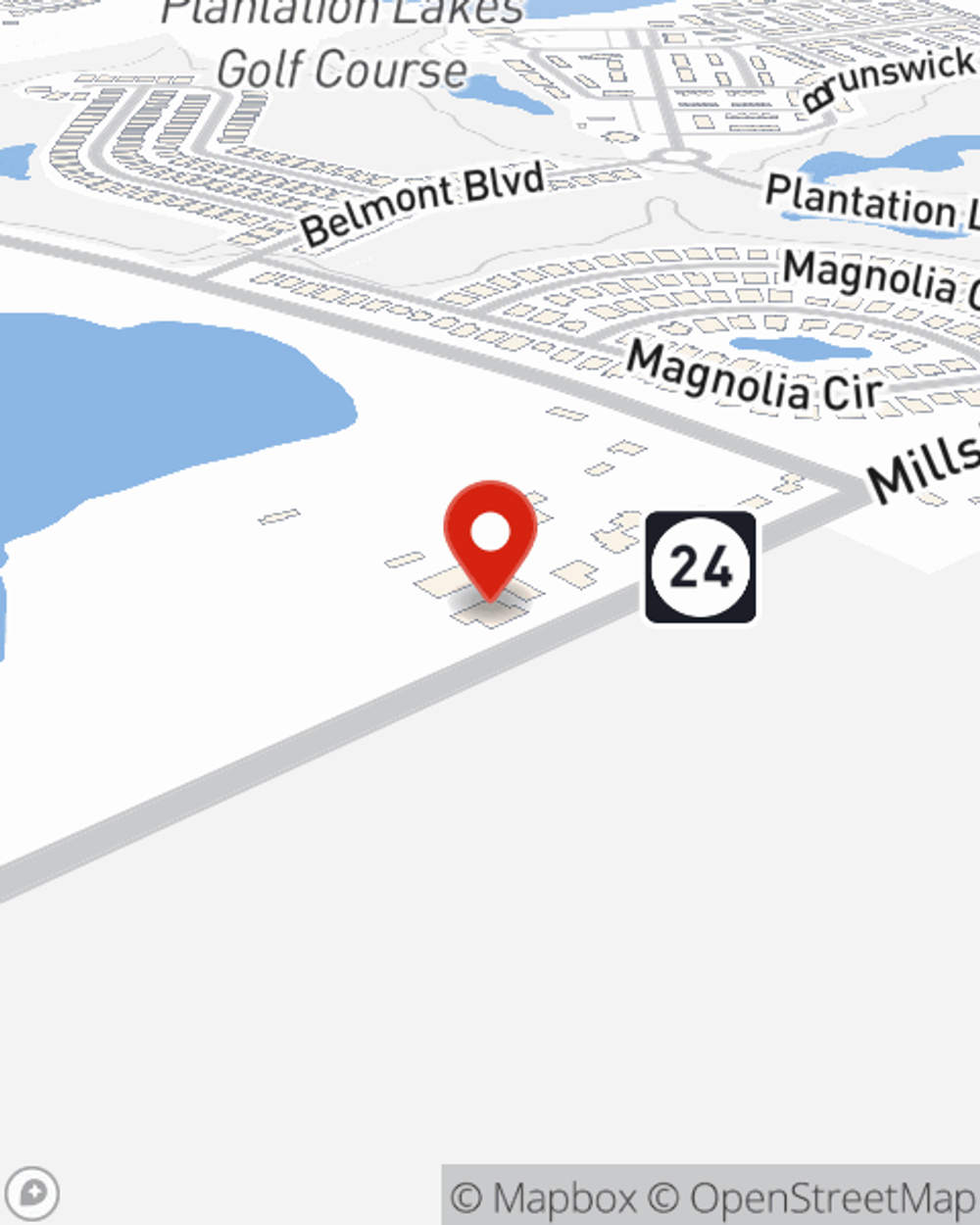

Business Insurance in and around Millsboro

Calling all small business owners of Millsboro!

Insure your business, intentionally

- Millsboro

- Long Neck

- Georgetown

- Lewes

- Dagsboro

- Frankford

- Gumboro

- Laurel

- Seaford

- Delmar

- Milton

- Rehoboth Beach

- Harbeson

- Milford

- Bridgeville

- Greenwood

- Angola

- Plantation Lakes

- Sussex County

Help Protect Your Business With State Farm.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Kim Benton. Kim Benton relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Calling all small business owners of Millsboro!

Insure your business, intentionally

Keep Your Business Secure

If you're looking for a business policy that can help cover extra expense, loss of income, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Kim Benton's office, it's our business to help insure yours. Visit our wonderful team to get started today!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Kim Benton

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.